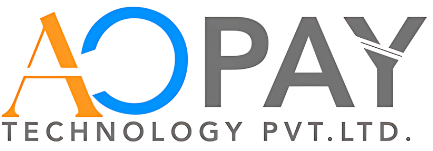

Revolutionizing Digital Lending Operations

Lending industry has transformed dramatically with the rise of digital loan apps, fintech platforms, and alternative lending models. As lending businesses scale from startup NBFCs to established financial institutions, they face increasing complexity in managing borrower verification, credit assessment, loan disbursement, and regulatory compliance across diverse market segments.

Faster Loan Processing

90% faster loan processing with automated verification workflows, reducing turnaround time and improving borrower satisfaction.

Automated Underwriting

75% reduction in manual underwriting tasks through intelligent automation and data-driven credit assessment models.

Enhanced Borrower Experience

85% improvement in borrower onboarding experience and satisfaction with seamless, digital-first loan application flows.

Virtual Account API Use Cases

Discover how businesses across industries leverage our Virtual Account solution for streamlined payment collection:

E-commerce Order Payments

Create unique virtual accounts for each customer order. Enable customers to pay via bank transfer with automatic order confirmation and inventory updates upon payment receipt.

B2B Invoice Collection

Generate virtual accounts for business invoices with automated reconciliation. Perfect for enterprises managing multiple client payments with varying settlement terms.

Educational Fee Collection

Streamline student fee collection with dedicated virtual accounts for each student. Automatic fee reconciliation with student management systems and instant payment confirmations.

Real Estate & Property Payments

Manage property bookings, EMI collections, and maintenance payments with individual virtual accounts. Automated tracking for property developers and management companies.

Healthcare & Insurance

Collect insurance premiums, treatment fees, and claims settlements with dedicated virtual accounts. Seamless integration with healthcare management systems.

Supply Chain & Logistics

Automate vendor payments, freight collections, and COD settlements with virtual account-based payment processing. Perfect for logistics and delivery companies.

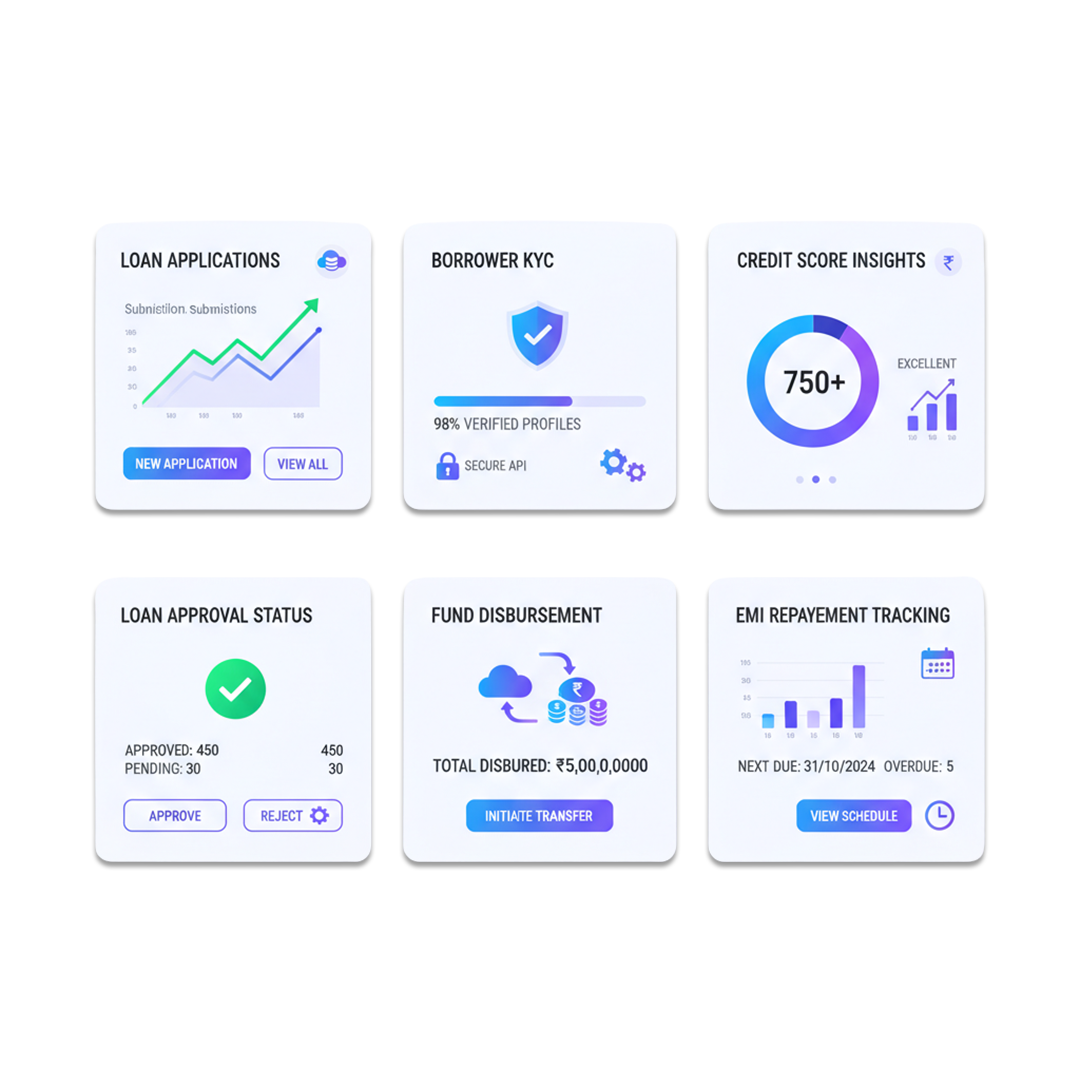

AOPAY Comprehensive Credit Verification Solutions

Ensure accurate borrower assessment with our integrated credit verification platform. Access multiple data sources, perform real-time checks, and build comprehensive borrower profiles for informed lending decisions.

CIBIL Credit Scoring Integration

Access real-time CIBIL credit scores and detailed credit reports to evaluate borrower creditworthiness. Our seamless integration provides instant credit assessments, helping you make faster, more accurate lending decisions while maintaining regulatory compliance.

Aadhaar Identity Verification

Verify borrower identity instantly with Aadhaar-based authentication. Our secure integration ensures accurate identity verification, prevents fraud, and streamlines the KYC process while maintaining data privacy and security standards.

PAN & GST Verification

Validate borrower income and business credentials through PAN and GST verification services. Access tax filing history, business turnover data, and financial records to assess borrower repayment capacity and business stability.

Integrated Banking Solutions for Seamless Operations

Connect your lending platform with comprehensive banking services to streamline fund management, automate collections, and enhance borrower experience with integrated financial services.

Bank Account Verification

Instantly verify driver and vendor bank accounts to ensure secure, accurate payments. Reduce failed transactions, prevent fraud, and maintain compliance with financial regulations while onboarding new partners quickly.

E-NACH Automated Collections

Set up automated loan repayment collections through E-NACH mandates. Streamline EMI collections, reduce default rates, and improve cash flow management with reliable, automated debit collection systems.

Virtual Account Management

Create dedicated virtual accounts for loan disbursement and collection tracking. Improve reconciliation processes, enhance payment visibility, and provide borrowers with personalized account management experiences.

Core Banking & Investment Platform Integration

Expand your lending services with integrated banking and investment solutions. Offer borrowers comprehensive financial services while creating additional revenue streams and improving customer lifetime value.

Core Banking Software

Integrate core banking functionalities to offer savings accounts, current accounts, and banking services to your borrowers. Create a comprehensive financial ecosystem that enhances customer relationships and drives business growth.

FD & RD Investment Services

Provide fixed deposit and recurring deposit options to borrowers looking to build savings and improve their credit profiles. Our integrated investment platform helps customers achieve financial goals while generating additional revenue for your business.

Instant Fund Disbursement

Disburse approved loans instantly to borrower accounts through our high-speed payment processing infrastructure. Support multiple disbursement channels including bank transfers, digital wallets, and prepaid cards for maximum convenience.

AOPAY Comprehensive Borrower Verification Methods

Access multiple verification touchpoints to build complete borrower profiles and make informed lending decisions with confidence.

CIBIL Credit Score

Aadhaar Verification

PAN Validation

GST Records

Bank Statement Analysis

Income Verification

Employment Check

Address Verification

Mobile Verification

Email Validation

Social Media Profiling

Behavioral Analytics

AOPAY Streamlined Loan Processing Workflow

AOPAY automated loan processing system guides borrowers through a seamless application journey while providing lenders with comprehensive risk assessment and decision-making tools.

Application Intake

Borrower submits loan application through mobile app or web portal with basic information and required documents.

Identity Verification

Automated verification of Aadhaar, PAN, and other identity documents using secure verification services.

Credit Assessment

CIBIL score retrieval, bank statement analysis, and comprehensive creditworthiness evaluation.

Automated Decision

AI-powered underwriting engine processes all data points and generates loan approval decision with terms.

Fund Disbursement

Instant loan disbursement to verified bank account or digital wallet upon acceptance of terms.

Collection Setup

E-NACH mandate setup for automated EMI collection and ongoing loan management.

AOPAY Tailored Solutions for Every Lending Business Size

Small-Scale Fintech Startups

Emerging fintech companies and loan app startups benefit from our plug-and-play lending infrastructure that eliminates the need for complex in-house development. Rapid market entry with automated credit verification, instant loan processing, and regulatory compliance features. Start with basic personal loan products and scale operations as your business grows.

Mid-Scale NBFC Operations

Established NBFCs and mid-market lending companies require sophisticated tools for managing diverse loan products and growing customer bases. Supports multiple lending verticals including personal loans, business loans, and specialized financing products. Advanced analytics and portfolio management tools provide insights while ensuring regulatory compliance.

Large-Scale Financial Institutions

Enterprise lending institutions and banks need comprehensive platforms that handle high transaction volumes while maintaining strict security and compliance. Supports complex operations including consortium lending, multi-tier approval workflows, and advanced risk management systems. Seamless integration with core banking and third-party services.

Advanced Risk Management & Regulatory Compliance

Real-Time Fraud Detection

Advanced machine learning algorithms monitor loan applications and disbursements for fraudulent patterns, protecting your business from identity theft, synthetic fraud, and application manipulation.

Regulatory Compliance Automation

Automated compliance monitoring ensures adherence to RBI guidelines, fair practices code, and industry regulations. Generate required reports, maintain audit trails, and stay updated with changing regulatory requirements.

Portfolio Risk Analytics

Comprehensive risk assessment tools analyze portfolio performance, predict default probabilities, and optimize lending strategies based on historical data and market trends.

Data Security & Privacy

Enterprise-grade security infrastructure protects sensitive borrower data with encryption, access controls, and secure data storage compliant with data protection regulations.

Easy Integration with Lending Ecosystem

Core Banking Systems

Sync with existing banking infrastructure and account management systems.

Credit Bureau Integration

Connect with multiple credit bureaus for comprehensive credit assessment.

Accounting Software

Automated financial reporting and reconciliation with popular accounting platforms.

Collection Agencies

Integrate with collection partners for comprehensive recovery management.

Document Management

Connect with document storage and verification services.

Communication Platforms

SMS, email, and WhatsApp integration for borrower communication.

Scale Your Lending Platform with Industry Growth

As the digital lending industry continues to evolve, AOPAY's platform grows with your business, supporting expansion into new products, markets, and customer segments without requiring major infrastructure changes.

Product Expansion

Add new loan products and financial services seamlessly.

Geographic Scaling

Expand to new states and regions with automated compliance.

Volume Handling

Process thousands of loans daily with high-performance infrastructure.

Market Adaptation

Quick deployment of new features based on market demands.

Technology Evolution

Regular updates with latest fintech innovations and regulatory changes.

Partnership Integration

Connect with new banking and fintech partners effortlessly.

Expert Support for Digital Lending Transformation

Partner with AOPAY's lending technology experts to build, optimize, and scale your digital lending operations. Our specialized team provides comprehensive support from platform design to regulatory compliance and business optimization.

Platform Implementation

End-to-end implementation support including system design, integration, testing, and go-live assistance with dedicated project management and technical expertise.

Regulatory Consulting

Expert guidance on RBI regulations, compliance requirements, and industry best practices to ensure your lending operations meet all regulatory standards.

Business Optimization

Ongoing analysis and recommendations to improve approval rates, reduce defaults, optimize pricing strategies, and enhance overall lending performance.

Frequently Asked Questions

How quickly can we launch our loan app with AOPAY platform?

What verification services are integrated with the AOPAY lending platform?

How does AOPAY ensure regulatory compliance for lending operations?

Can AOPAY platform handle high-volume loan processing?

What makes AOPAY different from other payment solutions for logistics?

Does AOPAY support different types of lending products?

Ready to Transform Your Digital Lending Operations?

Launch your loan app or scale your existing lending business with AOPAY's comprehensive platform. From credit verification to loan management, we provide everything you need to succeed in digital lending.

Loan Management Solutions

Comprehensive loan processing, automated underwriting, portfolio management, and collection automation for efficient lending operations.

Credit Verification Services

Real-time CIBIL scoring, identity verification, income validation, and comprehensive borrower assessment for informed lending decisions.

As the digital lending industry continues to evolve with technological innovation and changing consumer expectations, having the right technology infrastructure is crucial for sustainable growth and competitive advantage. AOPAY's comprehensive lending platform ensures your business stays ahead of market trends while maintaining operational excellence, regulatory compliance, and superior borrower experiences in the dynamic financial services landscape.