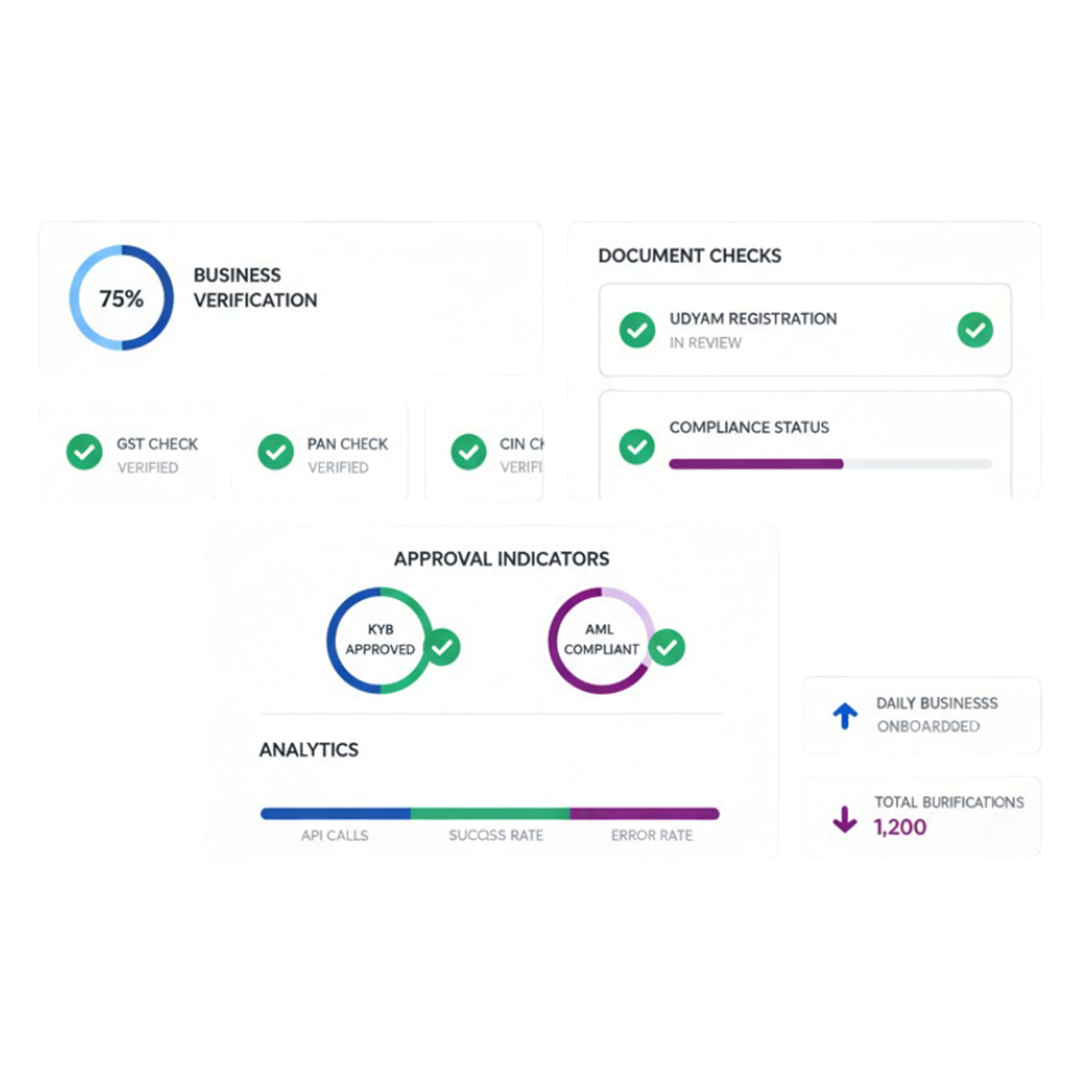

Complete Business Verification

AOPAY business verification API goes beyond basic company checks. We provide real-time access to official business registries, corporate filings, ownership structures, and beneficial owner information across 180+ jurisdictions.

Whether you're onboarding a new corporate client, conducting ongoing due diligence, or meeting regulatory requirements, our KYB API automates the entire verification workflow.

Core Features of Our Business Verification API

Everything you need for complete corporate due diligence and KYB compliance in one powerful API.

Company Verification

Instantly verify business registration status, company name, registration number, incorporation date, business address, and operational status across global registries.

UBO Identification

Automatically identify Ultimate Beneficial Owners (UBOs) through complex ownership structures. Trace ownership chains to individuals holding 25% or more beneficial ownership.

Document Verification

Validate business documents including certificates of incorporation, tax IDs, business licenses, and corporate resolutions with AI-powered document analysis.

Regulatory Compliance

Meet AML/CFT regulations, FATF recommendations, and industry-specific compliance requirements with automated KYB workflows and audit trails.

Risk Assessment

Automated risk scoring based on business jurisdiction, industry sector, ownership structure, compliance history, and financial stability indicators.

Ongoing Monitoring

Continuous monitoring of business changes, ownership updates, regulatory actions, and adverse news with real-time alerts and webhooks.

Global Coverage

Access business data from 180+ countries including corporate registries, trade registers, tax authorities, and local business databases.

Real-Time Verification

Get instant verification results in under 15 seconds with direct API connections to official registries and proprietary data sources.

How AOPAYKYB Compliance API Works

Simple integration, powerful results. Start verifying businesses in minutes with our developer-friendly API.

Step 1: Simple API Integration

Integrate our KYB API using our comprehensive SDKs for Python, Node.js, Java, PHP, and more. Our sandbox environment lets you test all features before going live. Example API call: POST /api/v1/kyb/verify { "company_name": "Tech Innovations Inc", "registration_number": "12345678", "country": "US", "jurisdiction": "Delaware", "include_ubo": true, "screening": { "sanctions": true, "pep": true, "adverse_media": true } }

Step 2: Comprehensive Verification

Our system automatically queries official business registries, validates company information, identifies beneficial owners, and screens against sanctions lists - all in real-time.

Step 3: Instant Results & Reporting

Receive detailed verification reports including company status, ownership structure, UBO details, risk scores, and compliance flags. All data is audit-ready and formatted for regulatory reporting.

Why Choose Our Corporate Due Diligence Solution?

Built for financial institutions and fintechs that demand accuracy, speed, and regulatory compliance.

Unmatched Data Coverage

Access 600M+ business records from official registries, commercial databases, and proprietary sources

Fastest Verification

Complete KYB checks in under 15 seconds with direct registry connections and optimized data retrieval

Regulatory Compliant

Meet AML/CFT, FATF, AMLD5, and jurisdiction-specific KYB requirements automatically

Developer-Friendly

RESTful API design, comprehensive documentation, SDKs, webhooks, and sandbox testing environment

Accurate UBO Identification

Trace complex ownership structures through multiple layers to identify true beneficial owners

Real-Time Updates

Automated monitoring alerts you to ownership changes, regulatory actions, and compliance risks instantly

Cost-Effective

Reduce manual verification costs by up to 90% while improving accuracy and compliance coverage

24/7 Support

Expert technical support and compliance guidance from our dedicated team of KYB specialists

Perfect for Compliance-Heavy Industries

Our business identity verification solution serves organizations across regulated sectors.

Financial Institutions

Banks and credit unions use our KYB API to onboard corporate clients, verify business accounts, and maintain ongoing compliance with banking regulations.

Fintech Companies

Digital payment platforms, lending fintechs, and neobanks automate business verification for merchant onboarding and account opening processes.

Neo-Banks

Digital-first banks streamline corporate account opening with automated KYB checks, UBO verification, and real-time compliance screening.

Payment Service Providers

PSPs and payment aggregators verify merchant businesses, assess risk profiles, and maintain compliance with payment industry regulations.

B2B SaaS Platforms

Enterprise software platforms embed KYB verification to offer compliant business verification as a feature for their customers.

B2B Marketplaces

Business-to-business marketplaces verify seller legitimacy, reduce fraud, and build trust with automated business verification.

Insurance Companies

Insurers verify corporate policy holders, assess business risk, and comply with anti-money laundering requirements efficiently.

Accounting & Tax Firms

Professional services firms verify client businesses, conduct due diligence, and maintain regulatory compliance documentation.

Key Use Cases for Business Verification API

Business Onboarding

Automate corporate customer onboarding with instant company verification, document validation, and UBO identification. Reduce onboarding time from days to minutes.

Merchant Verification

Verify merchant businesses for payment processing, e-commerce platforms, and marketplace operations. Assess risk and prevent fraudulent merchant accounts.

Lending & Credit Assessment

Verify business borrowers, validate financial documents, and assess corporate creditworthiness for business lending and invoice financing.

Vendor Due Diligence

Screen and verify suppliers, contractors, and business partners to ensure compliance and mitigate third-party risks in your supply chain.

AML/CFT Compliance

Meet anti-money laundering and counter-financing of terrorism requirements with comprehensive business screening and UBO verification.

Ongoing Monitoring

Continuously monitor existing business relationships for ownership changes, sanctions hits, regulatory actions, and adverse news events.

Developer-Friendly API Features

Built by developers, for developers. Our API prioritizes ease of integration and reliability.

Comprehensive SDK Support

- Python, Node.js, Java, PHP, Ruby, C# SDKs

- REST API with JSON responses

- GraphQL endpoint for flexible queries

- Webhook support for async notifications

- Batch processing for bulk verifications

Enterprise-Grade Infrastructure

- 99.9% uptime SLA guarantee

- Auto-scaling for high-volume processing

- Rate limiting and quota management

- Encrypted data transmission (TLS 1.3)

- Geographic redundancy and failover

Advanced API Capabilities

Batch Processing

Verify hundreds of businesses simultaneously with our bulk verification endpoint. Perfect for data migration and compliance audits.

Custom Workflows

Configure verification rules, risk thresholds, and approval workflows to match your specific compliance requirements.

White-Label Solution

Embed our KYB verification into your platform with custom branding, seamless UI integration, and your own domain.

Comprehensive Data Sources

We aggregate data from trusted sources to provide the most complete business verification available.

Official Business Registries

Direct connections to companies houses, corporate registries, and commercial registers in 180+ countries for verified company data.

Financial Data Providers

Credit reports, financial statements, and business credit scores from leading financial information providers globally.

Driver's Licenses

Verify driver's licenses and learner permits from all US states, Canadian provinces, and international jurisdictions.

Sanctions & Watchlists

Real-time screening against OFAC, UN, EU, HMT, and 200+ global sanctions lists plus PEP and adverse media databases.

Corporate Filings

Access to annual reports, beneficial ownership registers, director information, and corporate structure documents.

Industry Registries

Verify licenses, permits, and registrations for regulated industries including financial services, healthcare, and professional services.

News & Media

Adverse media screening across 50,000+ global news sources in multiple languages for reputation and compliance risks.

Enterprise Security & Compliance

Your data security and regulatory compliance are our top priorities.

Bank-Grade Security

- End-to-end encryption for all data transmissions

- SOC 2 Type II certified infrastructure

- ISO 27001 information security standards

- Regular third-party security audits

- Multi-factor authentication and role-based access

- GDPR and CCPA compliant data handling

Audit-Ready Reporting

Generate comprehensive audit trails, compliance reports, and documentation for regulatory examinations. All verification activities are logged with timestamps and data provenance to ensure traceability and compliance integrity.

Flexible Pricing for Every Business Size

From startups to enterprises, we have a plan that scales with your business needs.

Startup Plan

Perfect for early-stage companies and fintechs. Includes essential KYB verification features with pay-as-you-grow pricing.

Business Plan

For growing companies with higher verification volumes. Includes advanced features, priority support, and volume discounts.

Enterprise Plan

Custom solutions for large financial institutions. Dedicated infrastructure, SLA guarantees, and white-label options available.

Ready to Automate Your KYB Compliance?

Join financial institutions and fintechs that trust our KYB API for business verification. Start with our free sandbox and experience the difference of accurate, fast, and compliant business verification.